How Much Does College Really Cost?

Last Updated on November 20, 2025 by Jill Schwitzgebel

Some states have made state universities affordable for in-state students, especially if they also offer in-state scholarships, like the Bright Futures scholarship in Florida. But, as state budgets tighten across the country, often funding for state universities gets slashed, and colleges have to make up for that by increasing tuition. And the sticker prices can look intimidating.

See also: Public Vs. Private College: Understanding the Differences

Here are some things you need to understand about college costs and financing so that you can make informed decisions during your college search.

Net Price Calculator

Most of us hope to be able to support our children’s college dreams. But, when they’re looking at an out-of-state public college or a small private college, it’s easy to think that’s impossible. But, often it can be done with a little research. The very first place to start is with a college’s Net Price Calculator (NPC).

Every college has to have this on their website somewhere, but in my experience, it is easier to find for some colleges than others. You may want to begin by looking in the Financial Aid section of the school’s website, although it will usually pop up if you Google it. (“{College Name} and Net Price Calculator”)

Once you have found the Net Price Calculator, you will enter all kinds of information, including things like family size, information from your tax return, etc. Some calculators want more detailed information than others, including your child’s GPA or test scores (so that they can calculate in any automatic scholarships also). Don’t be annoyed by that! Be glad, because you will get a more accurate answer from them. I have found these calculators to be amazingly accurate, although they are not quite as accurate if you are a small business owner.

Some highly competitive schools, like Princeton, will be MUCH cheaper for you than what their intimidating “sticker” cost would appear to be. So don’t let that price fool you into thinking it is out of your financial league if your student has the potential grades and GPA to apply. Go ahead and check out that NPC.

When your student has gotten serious about applying to schools at the beginning of their senior year, you may even want to consider contacting a school’s financial aid office and asking them if they would be willing to do a “financial pre-screen”. You will submit the information that they request, and then the school will provide you with what they believe is a good breakdown of what you would be expected to pay if your child were to get in and decide to attend. This may be especially important if your child wants to apply to a school through Early Decision (which is binding) and you want to be sure that you will be able to pay for it before they apply.

Cost of Attendance and Other Confusing College Admission Terms

FAFSA

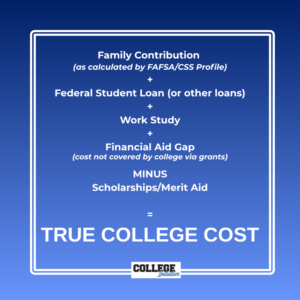

After you have used the school’s Net Price Calculator, you may do what I did, which is to sit and laugh that they actually believe you can afford to pay as much as they expect you to pay. Trust me, you will likely have the very same experience when you fill out the FAFSA and see what the government says you can afford, during fall of your student’s senior year. The FAFSA will give you a number called the Student Aid Index (this replaces the the EFC). Our reaction when we first filled that out was something along the lines of “Soooo…we aren’t supposed to even buy groceries for ourselves while our kids are in college?”

What’s worse, is that some colleges, especially public universities, will often expect you to pay even MORE than what the FAFSA says you’re expected to pay (you’ll know this if you have already run the school’s NPC). So now you may be on a mission to find a way to reduce that cost somehow!

Does the College Meet Students’ Financial Need?

There are a variety of ways to reduce your costs, but a place to begin would be by looking at schools that say they will “meet full financial need.” In other words, if the FAFSA says that you can only afford $10k, that college will make sure that you will only pay $10K. Here‘s a recent list of colleges that claimed to meet full need. However, many more say that they meet above 90% of your financial need.

When schools do not meet full financial need, they may expect you to pay $15k, even if your SAI number indicates you can afford only $10k, because they do not have the funds to provide the aid you need. It’s known as “financial gapping” when they expect you to pay more than you anticipated based on the SAI number you were given. That means you’ll be expected to somehow pay $5k MORE than what the FAFSA says you can afford (which is likely already higher than YOU feel that you can afford).

When you are using the CollegeBoard’s search tool, which I mentioned here, you will see how much of your estimated need each college will meet. This information is also found in the college’s Common Data Set, which is the most reliable source. Now, keep in mind, many (most) colleges will use student loans and/or work study as part of the way that they will meet your financial need. But not all of them do.

Financial Aid Grants

To help make up the difference between what the FAFSA says you can afford to pay, and the college’s actual tuition, the college may also give a financial aid grant. Depending on income, your family could be eligible for a federal Pell grant to help make tuition affordable. And, as mentioned above, often colleges will offer their own financial aid grants. This is great because grants are gifts that do not have to be paid back! They are simply given to help students afford college. But, not every school has the funds available to cover the full difference between your EFC and tuition cost.

Loans and Work Study

This is a sneaky thing that not all parents realize. When meeting your financial need, colleges will usually consider student loans and work study programs as part of your financial aid. If the college cost is $20k, and your EFC is $10k, and the college says that they will meet full financial need, the college may give you $5k in grant money (a gift, as mentioned above). BUT, they will usually also “meet need” by having your student use a federal student loan of $5K to cover those remaining costs. So while that grant plus the loan would cover the tuition for that year, it still leaves your student responsible for part of those costs after they graduate. So, “meets full need” may differ from your own definition of meeting full need.

The other thing a college may do to help meet your student’s financial need is to grant them a federal work study job. This is a job on campus – maybe monitoring a computer lab, maybe helping in an administrative office – where they will expect your student to earn a set amount to contribute toward tuition.

One thing that parents often don’t understand is that on some campuses, those jobs are NOT easy to get. Students are not automatically given a job just because they qualified for some amount of work study money. It’s not unusual for it to take a semester or two for the student to be able to get hired. Additionally, this is money they will earn throughout the year, it is not money that they’re paid upfront that can be used to help pay the tuition bill when it comes due.

Scholarships?

So, after you have hopefully gotten closer to your family contribution via loans, work study, and grants, it is time to to think about other ways to reduce costs – scholarships. The very best source for meaningful scholarship money is going to be the colleges themselves. While that $500 PTA scholarship is nice, it is a one-time thing that may cover the cost of books for the year. Additionally, for some colleges, that $500 outside scholarship is going to do nothing more than raise your expected contribution the following year, because the college may ask about outside scholarships and then reduce your aid accordingly.

But, colleges themselves offer all kinds of academic, athletic, arts, and even community service scholarships. Typically, these are worth thousands every single year. It is not uncommon for students at colleges with $60k stickers on them to only be paying as much or a little more than they would pay at their state university, because those expensive schools often have the endowments to pay for lots of scholarships and financial aid grants.

See also:A Word About Scholarships

Keep in mind that academic scholarships often have a minimum GPA requirement in order for the student to continue to receive that scholarship. In some cases, especially freshman year, it may not be all that easy to hit that minimum, so be sure to read the fine print.

YOUR Price

This is only a fraction of what there is to know about college financing. But, this should provide an overview so that you have an idea of where to begin conversations.

Prior to putting together the college application list, I recommend that you have a firm understanding of what your costs are likely to be. That’s the best way to avoid disappointment when acceptance time rolls around. It is a terrible feeling to discover in April of their senior year that there is no way you will be able to afford your child’s dream school.